Since I was a kid every single time a new administration came into “Palacio Nacional”, an air of uncertainty, speculation, and doubt invaded the daily conversation.

It makes sense, a change of administration has triggered two of the worst economic crisis the Mexican Economy has suffered.

Today a new chapter of Mexican history begins with the first woman to be the leader of our country. She is receiving a country with a lot of infrastructure in development across different sectors like transportation, tourism, and energy. This requires a lot of investment that the Mexican Government has been able to get through partnerships and debt management. This is perfectly normal, Mexico has always been a country that finances its infrastructure development with debt due to the great score and interest rates we got as a global economy.

But in the last few years, the volatility of the markets and interest rates has been unpredictable. If this is not enough let’s also consider that the US is about to have one of the most radical elections in its history.

So I am a guy who is into Forex, most of my life I’ve been able to work in foreign markets leveraging the parity between USD/MXN or EUR/MXN. This represented an advantage a few years ago when you were able to forecast the behavior of these parties. But after the pandemic, and with this constant intent of avoiding a recession by the US Fed the volatility in Forex has made planning a great challenge.

So a few weeks ago, I wrote about Pathfinder algorithms applied to trading strategies. Today with all the volatility going around and today becoming one of these zero moments in Mexican history. I thought it would interesting to talk about leveraging Pathfinder Algorithms for Forex trading.

What is Forex?

Forex, short for "foreign exchange," refers to the global marketplace for buying and selling currencies. It’s the largest and most liquid financial market in the world, where currencies are traded in pairs (e.g., EUR/USD, GBP/JPY).

A forex strategy is a systematic approach traders use to decide when to buy or sell currency pairs in the foreign exchange market. These strategies are based on technical analysis, fundamental analysis, or a combination of both.

What should we consider when we create a Forex Trading strategy?

Risk Tolerance

Market Conditions

Time Commitment

So how can we apply pathfinder algorithms to a Forex Trading strategy?

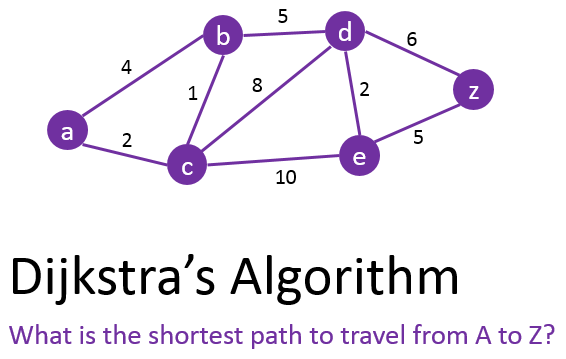

Dijkstra's Algorithm

Dijkstra's Algorithm is a pathfinding algorithm used to find the shortest paths between nodes in a graph. In the context of forex trading, each currency pair can be represented as a node, and the edges between them can represent the cost or risk associated with trading between those currencies.

We will use it for:

Optimal Currency Pair Selection: By applying Dijkstra's Algorithm, we can determine the most cost-effective route for executing trades among multiple currency pairs. For instance, if we want to convert USD to MXN while also considering potential conversions through EURO or BTC, Dijkstra’s algorithm can help identify the path with the lowest transaction costs.

Risk Assessment: The algorithm can also factor in volatility and liquidity as weights on the edges. This means that not only will it find the cheapest route, but it will also consider the stability of each currency pair involved in the trade.

A* Search Algorithm

The A* Search Algorithm is an extension of Dijkstra's Algorithm that uses heuristics (a simplified route) to improve efficiency. It finds the shortest path by considering both the cost to reach a node and an estimated cost to reach the goal from that node.

We will use it for:

Dynamic Market Adaptation: In forex trading, market conditions can change rapidly. The A* algorithm can be employed to adaptively find trade paths based on real-time data inputs such as price movements, trading volume, and economic indicators. For example, if we are looking to optimize trades involving ETH and BTC alongside traditional currencies, A* can quickly evaluate which paths are likely to yield the best outcomes given current market conditions.

Predictive Trading: By incorporating predictive analytics into the heuristic function of A*, we can anticipate price movements based on historical data and market trends. This allows for more proactive trading strategies that adjust as new data becomes available.

Trend Following: A* can be used to identify emerging trends by analyzing historical price data and current market conditions. By incorporating heuristics that predict future price movements based on past trends, A* can guide us to enter positions aligned with upward or downward trends effectively.

Dynamic Rebalancing: A* algorithm allows for real-time adjustments to trading strategies based on new data inputs (e.g., sudden shifts in inflation rates or commodity prices).

Risk Management: By evaluating potential paths not only based on cost but also on risk factors (like volatility), A* helps us to forecast the risk.

Application in Forex Strategy:

Optimal Currency Pair Selection: By applying Dijkstra's Algorithm, traders can determine the most cost-effective route for executing trades among multiple currency pairs. For instance, if a trader wants to convert USD to MXN while also considering potential conversions through EURO or BTC, Dijkstra’s algorithm can help identify the path with the lowest transaction costs.

Risk Assessment: The algorithm can also factor in volatility and liquidity as weights on the edges. This means that not only will it find the cheapest route, but it will also consider the stability of each currency pair involved in the trade.

2. A* Search Algorithm

Overview: The A* Search Algorithm is an extension of Dijkstra's Algorithm that uses heuristics to improve efficiency. It finds the shortest path by considering both the cost to reach a node and an estimated cost to reach the goal from that node.

Application in Forex Strategy:

Dynamic Market Adaptation: In forex trading, market conditions can change rapidly. The A* algorithm can be employed to adaptively find trade paths based on real-time data inputs such as price movements, trading volume, and economic indicators. For example, if a trader is looking to optimize trades involving ETH and BTC alongside traditional currencies, A* can quickly evaluate which paths are likely to yield the best outcomes given current market conditions.

Predictive Trading: By incorporating predictive analytics into the heuristic function of A*, traders can anticipate price movements based on historical data and market trends. This allows for more proactive trading strategies that adjust as new data becomes available.

Forex Trading Strategy Using Pathfinding Algorithms

Strategy Step by Step

Data Collection:

Gather real-time data on exchange rates for USD, MXN, EURO, BTC, and ETH.

Connect data flows for economic indicators and news that may affect currency volatility.

Graph Construction:

Construct a graph where each node represents a currency pair.

Define edges based on transaction costs (spreads), liquidity (depth of market), and risk factors (volatility).

Pathfinding Execution:

Use Dijkstra's Algorithm to find initial optimal paths for basic trades.

Implement A* Search Algorithm to refine these paths dynamically based on real-time market conditions.

Trade Execution:

Execute trades along the identified paths while continuously monitoring market conditions.

Adjust strategies based on feedback from executed trades and ongoing analysis.

Risk Management:

Incorporate stop-loss orders and take-profit levels based on volatility assessments derived from algorithm outputs.

Regularly review and adjust trading parameters to reflect changing market dynamics.

Example

Suppose we want to convert USD into MXN while also considering potential trades through EURO or BTC due to favorable conditions:

Initial Analysis with Dijkstra's Algorithm:

The algorithm identifies that converting USD → EURO → MXN offers lower transaction costs than direct USD → MXN conversion due to lower spreads in EUR/MXN.

Refinement with A*:

As market conditions shift (e.g., BTC shows unexpected volatility), A* recalibrates the optimal path by considering this new information and suggests an alternative route through BTC instead of EURO if it predicts better returns.

Execution and Adjustment:

We execute trades based on these optimized paths while continuously monitoring for any changes that might affect future trades.

The finance world is infinite and this is not an intent for financial advice or investment strategy, is just an exercise done by someone who has lived with two or more currencies most of his professional life.